Contents

To set target levels, traders need to measure the vertical distance between the support and resistance lines at the starting point of the wedge. They should then superimpose this distance at the current price, where the top end of the line will be the target. There is, however, one condition that the price must break out of the wedge pattern at least once reward for reporting tax fraud before. A symmetrical triangle is a chart formation in which the slope of the price highs and the slope of the price lows converge to form a triangle. What’s happening is that the market is making lower highs and higher lows during this formation. This indicates that neither buyers nor sellers are pushing the price far enough to establish a clear trend.

• The second is falling wedge where price is contained by two descending trend lines that converge because the upper trend line is steeper than the lower trend line. Banknifty after a extreme bullish view posted way back has achieved most of the upside targets. It is basically the inverted version of the ascended triangle pattern. Here, the lower trendline is horizontal, joining the near-identical lows. The upper trendline meets the lower trendline through its diagonal inclination to form an apex.

The break, meanwhile, must preferably be accompanied by an increase in volume. Essentially, this pattern indicates a shift from sellers to buyers. Failure of price to make a new low during the formation of the right shoulder indicates that selling is receding. Then, a break above the neckline suggests that the decline has ended.

After the steep decline in prices, there has been a consolidation phase and the formation of the wedge on the charts. In this article, we will talk about how we can identify trading opportunities using a rising wedge pattern and make use of them in order to make profitable trades. • The falling wedge pattern signals a possible buying opportunity in a downtrend.

Rising Wedge Pattern Screener

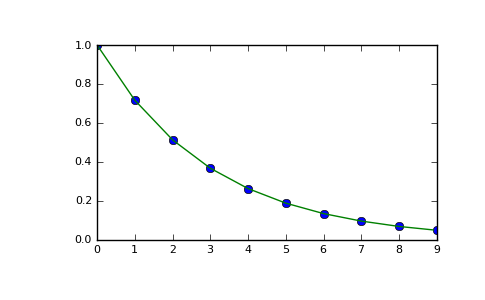

Notice the diminution in volume when price was within the triangle and how volume picked up once price broke out of the triangle. Also notice that the subsequent decline later on found support near the vicinity of the upper trendline, which then switched its role from resistance to support. They allow traders and investors to base their buying and selling activity on logic rather than luck. Thanks to data collected over several years and the cyclical nature of digital assets, we can look at patterns on a crypto chart and ascertain where the price of a token may be headed. One of the most common chart patterns is the rising or falling wedge.

However, notice the huge volume when price broke above the horizontal resistance line during its second attempt. Such a sharp pickup in volume during breakout of a resistance highlights the determination of bulls to buy at higher levels and thereby increase the odds of price heading higher. This example highlights how essential it is for a resistance breakout to be accompanied by increase in volume. A rectangle is a continuation pattern that could appear during an uptrend or a downtrend. A rectangle represents a pause to the ongoing trend, during which the price broadly consolidates within a set range. The pattern comprises of at least two identical peaks and at least two identical troughs.

Based on experience, an upward sloping or horizontal neckline is preferred over a downward sloping neckline. The Double Bottom Patterns are opposite of double top formation and are similar to the W pattern which indicates a bullish reversal. These reversal chart patterns are developed over a longer period.

Confirmation from the volume increases the probability of an up move once the neckline is broken. The entry is placed when either the price breaks above the top side of the wedge, or when the price finds support at the upper trend line. Without an expansion of volume, the breakout will lack conviction and be vulnerable to failure. The pattern is confirmed after the resistance line is broken in convincing fashion. It is sometimes prudent to wait for a break above the previous reaction high for further confirmation. Once resistance is broken, there can sometimes be a correction to test the newfound support level.

What ever the form it takes, do not try to anticipate the direction of the breakout. Just keep in mind that rectangles are more likely to continue the prevailing trend rather than reverse it. To identify a falling wedge pattern, draw lines linking lower highs and lower lows using a trendline. The trading volume should lessen during the falling wedge formation as the price has entered a consolidation stage before the bullish breakout. These short positions can be held until the price approaches the lower trendline or shows some signs of bottoming. Similarly, a long position can be initiated when price touches the lower line on any subsequent decline and then reverses to the upside.

List Of Abbreviations And Their Full Forms Used In Stock Markets

If this were a battle between buyers and sellers, it would end in a tie. Reversal patterns are particularly difficult to analyse and frequently have false breakouts. Nonetheless, we should not predict the direction of the breakout, but rather wait for it to occur.

- Talking about the volume characteristics, volume will usually decline when price is within the wedge, indicating at uncertainty over the falling prices.

- Keep in mind that volume is more important in case of an inverse H&S pattern than it is in case of a bearish H&S pattern.

- As a rule, volume during upward breakout is more important than volume during downward breakout.

- Sometimes the level of resistance is too high, and there is simply not enough run-up to push it through.

- We at Enrich Money, do not promise any fixed/guaranteed/regular returns/ capital protection schemes.

Once the decline starts from the high of the head, a chartist can draw an extended neckline connecting the high of the left shoulder and the high of the head. The drop from the high of the head fails to break the previous bottom before heading higher again. The pattern is complete and a reversal is indicated once price breaks above the neckline connecting the high of the left shoulder and the high of the head. The neckline could be downward sloping, horizontal, or upward sloping. Based on experience, a downward sloping or horizontal neckline is preferred over an upward sloping neckline. Rising Wedge Pattern is one of the tools used by traders who use technical analysis of stocks to initiate positions in stock and currency markets.

No worries for refund as the money remains in investor’s account. Neutral Strategies Neutral Options Strategies are options strategies that profit when the underlying stock remains… The price falls again, forming a second trough significantly https://1investing.in/ below the initial low, before rising again. The price again rises to form a second high that is significantly higher than the initial peak, and then falls again. The bottom trend line can be called as a support in the chart.

Shooting Star Candlestick Pattern

It usually shows up when a stock has been rising in prices over a period of time, but can also be exhibited in the middle of a downward trend. When the price trades outside the lower trendline, it is suggested that a potential short trade be initiated. An inverse H&S is a bullish reversal pattern that appears after a decline in price. The pattern consists of three troughs, just the opposite of its bearish counterpart. Once this bottom is made, price usually recovers part of the decline before finding resistance. Price then declines from the high of the left shoulder, makes a new low, and then heads higher and back towards the high of the left shoulder.

These long positions can be held until the price approaches the upper trendline or shows some signs of topping. Notice in the above chart how uneven the volume distribution was when the pattern was forming. Also notice the pickup in volume after the breakdown from the pattern, increasing the probability of price heading lower.

What makes a descending triangle bearish is the structure of the pattern. Each high is lower than its preceding high, suggesting that the sellers are aggressively offering the price at lower levels. Once the downside barrier is breached, expect this region to act as a resistance during any recoveries. An ascending triangle is a bullish continuation pattern that appears during an uptrend. However, sometimes, an ascending triangle can also appear as a reversal pattern, especially when it develops after a prolonged rally or a prolonged decline in price.

This pattern is formed by two lows below the resistance level, also known as the neckline. After a strong downtrend, the first low is formed, and prices retrace back to the neckline. After returning to its neckline, the price turns bearish and falls once more to form the second low. This pattern is completed when the prices return to the neckline after forming the second low. When prices break through the neckline or the resistance level, the bullish trend has reversed and traders can enter a long position.

Rounding bottom (Pattern type: Bullish Reversal)

Rising wedges can also be identified during a market downtrend. In contrast to a rising wedge pattern in a market uptrend, during a downtrend, one can observe a temporary price movement in the opposite direction. This pattern indicates a continuation of the market’s downtrend, as momentum slows in the share’s pricing. Traders use the pattern to find selling opportunities before the reversal.

The pattern begins with a pole formation, which represents a nearly vertical and steep price move. Following the steep rise, candlesticks contained in a small parallelogram by forming a flag pattern. It is a consolidation zone characterised by a counter-trend move that follows after a sharp price movement.

You need to identify your lower lows and lower highs on the chart. There are several things you note to trade the falling Wedge pattern effectively. Since this pattern can signal a continuation or reversal, there are specific things to note here.

Bottom Triangle Or Wedge Chart Pattern

The Wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend; however most of the time it is a reversal pattern. This indicates a slowing of momentum and it usually precedes a reversal to the upside. This means that you can look for potential buying opportunities.

This distance is then measured from the point of break to arrive at the price objective. Also, notice there was no marked pickup in volume during the breakdown. However, failure of price to move above the neckline more than offset this dull volume. This pattern is confirmed when the price breaks downward out of the Triangle/Wedge formation to close below the reduce trend line. The analysis and discussion provided on Moneymunch is for your education and entertainment only, it is not recommended for trading purposes.

Next, we will learn a completely different type of chart pattern called Wedges. The lack of a volume spike on the day of the pattern confirmation is an indication that this pattern may not be reliable. In addition, if the volume has remained constant, or was increasing, over the duration of the pattern, then this pattern should be considered less reliable. Buyers should see amount reducing as the pattern advances toward the apex of the Triangle.

Leave a comment